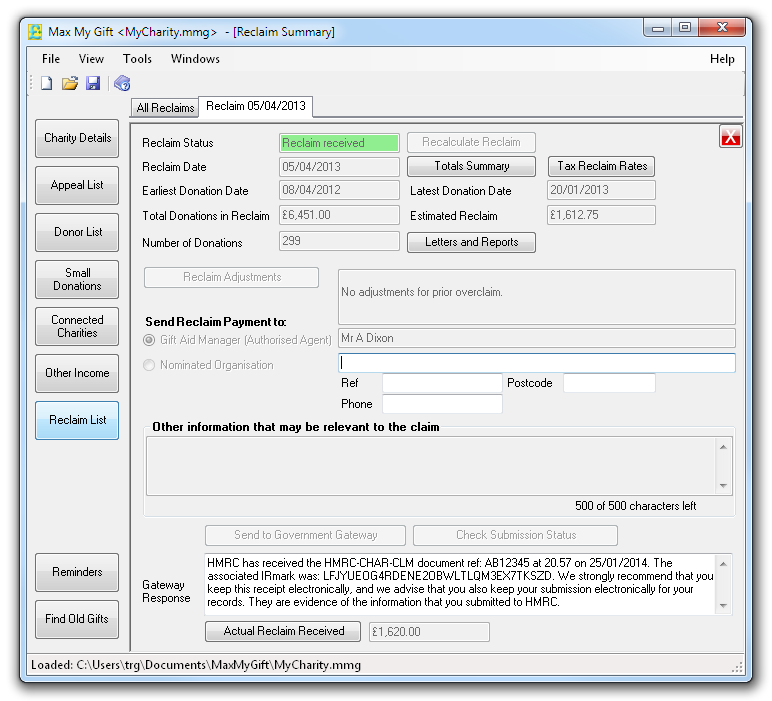

| Reclaim Status | The current status of the reclaim |

| Recalculate Reclaim | If there are any changes to the Gifts or the Declarations for any Donor the Gifts in the reclaim need to be recalculated using this button. |

| Reclaim Date | Gifts will be reclaimed up to and including this date. |

| Totals Summary | Opens up a Reclaim Totals Summary screen showing the Gifts totalled in various ways. |

| Tax Reclaim Rates | Opens a window showing the tax reclaim rate for the selected reclaim period. |

| Earliest Donation Date | The date of the earliest Gift reclaimed. |

| Latest Donation Date | The date of the latest Gift reclaimed. |

| Total Donations in Reclaim | The total amount of all the Gifts in the reclaim. |

| Estimated Reclaim | An estimate of how much the tax reclaim will be using the basic tax rate information. The actual amount will probably differ. This does not include Small Donations and Adjustments |

| Number of Donations | The total number of Gifts in the reclaim. |

| Letters to Donors and Treasurer | This button opens up the window to produce Donor Summary Letters and a report in the style of the old R68 Reclaim form (used before 2013). |

| Small Donations and Adjustments | allows a reclaim under the Gift Aid Small Donations Scheme. |