parent nodes: Reclaim List | Screens

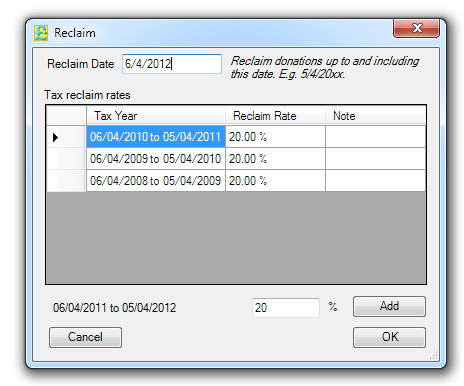

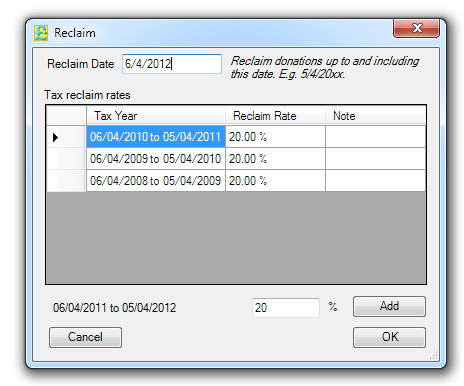

New Reclaim

Used to make a new Gift Aid tax reclaim.

The important information needed to make a claim is

The Reclaim Date

The Reclaim Tax rates over all the periods reclaimed.

Eligible Gifts are reclaimed up to and including the Reclaim Date. If all traceable Gifts are recorded it is possible that a series of Gifts in prior years not yet reclaimed may be included.

This is because the tax on Gifts can be reclaimed in arrear up to around 4 years.

The reclaim tax rate is generally the basic rate of Income Tax.

The form prompts for all the raclaim tax rates over the period of the reclaim if the rates have not been collected already.

The reclaim rates historically are:

| tax year | Reclaim Rate |

| 6/4/2006 to 5/4/2007 | 22% |

| 6/4/2007 to 5/4/2008 | 22% |

| 6/4/2008 to 5/4/2009 | 20% |

| 6/4/2009 to 5/4/2010 | 20% |

| 6/4/2010 to 5/4/2011 | 20% |

| 6/4/2011 to 5/4/2012 | 20% |

| 6/4/2012 to 5/4/2013 | 20% |

Double clicking on a rate opens a form to edit the Tax Reclaim Rate.